About the Book

“This book is a must for those timid souls who don’t enjoy risk taking…like me.” Franco Modigliani, Nobel Prize Winner, Economics

“Despite the sophisticated financial thinking underlying its recommendations, this book is accessible to all….As promised by its title, the focus of this book is on investment safety. But it is also a good read for those who are prepared to take significant investment risks. Creating a strong financial foundation to ensure essential goals predicates any strategy of intelligent and sustainable risk taking.” Robert C. Merton, Nobel Prize Winner, Economics

“Dr. Bodie, I wanted to take this opportunity to thank you for writing your book, Worry Free Investing. I purchased it shortly after its publication and have read it several times trying to absorb its lessons, and I have made it a point to purchase copies for my children who are certain to face a much more challenging and uncertain financial future. Your point of view is very refreshing given the current national debate over investing social security in the stock market and the decline of the defined pension plan. Your writing was insightful and your presentation was both easy to follow and convincing. Again thank you for your efforts and please consider writing additional books in your area of expertise for those of us outside the academic world who very badly need this type of discussion and advice.” Robert Ranlett

Book Content

- New Rules for Investing.

A New Strategy. New Investments. Six Steps to Worry-Free Investing. - Investing with Inflation-Protected Bonds.Setting Clear Goals.

Why Plan? Inflation Risk. The Ins and Outs of I Bonds. TIPS. How to Compute the Amount You Need to Invest. - Reaching Your Retirement Goal.

The Retirement Goal. Social Security. Employer-Sponsored Pensions. Guaranteeing That Your Income Lasts as Long as You Do. Income Taxes. Transaction Costs. Economy of Motion Savings. - Investing Safely for College.

High-Priced Item. Section 529 Plans. Investment Choices and Risks. Free Advice - Your Home as an Investment.

Is Buying Your Home a Safe Investment? Your Home as a Retirement Asset. Home Equity Conversion Plans. - Stocks Are Risky, Even in the Long Run.

Saving and Investing-Risk and Reward. An Objective View. Why Are Stocks Risky? Misleading Statistics. Simulating Stock Returns. The Effect of Periodic Withdrawals. Japan’s Stock Market Crash-An Example to Remember. - Taking Calculated Risks in the Stock Market.

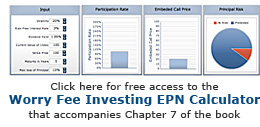

Who Should Invest in Stocks? Protecting Your Principal. Call Options. Combining Bonds with Stock Options. Convertible Bonds. Principal-Protected Equity-Participation Notes. - Investment Pitfalls and How to Avoid Them.

Myth 1: It Is Easy to Beat Stock Market Professionals at Their Own Game.

Myth 2: You Can Identify the Best Money Managers by Looking at Their Track Records.

Myth 3: Stocks Are Not Risky in the Long Run.

Myth 4: Stocks Are the Best Hedge Against Inflation.

Myth 5: Dollar Cost Averaging Improves Your Risk-Reward. Tradeoff.

Myth 6: An Age-Based Portfolio Strategy Is the Best Way to Secure Your Lifecycle Saving Targets. - Putting It All Together.

Step 1: Set Goals.

Step 2: Specify Targets.

Step 3: Compute Your Required No-Risk Saving Rate.

Step 4: Determine Your Tolerance for Risk.

Step 5: Choose Your Risky Asset Portfolio.

Step 6: Minimize Taxes and Transaction Costs. - Do You Need Professional Advice?

Many Kinds of Advisors. How to Find an Advisor You Can Trust. - Real-Life Examples of Worry-Free Retirement Investing.

Paul Younger. Mary and Marty Mature. Nancy and Steve Senior. - Frequently Asked Questions (FAQs).

• Whom Can I Trust?Is There Help Available from the SEC for Investors?

• How Do the Six Steps to Worry-Free Investing Differ from the SEC’s Roadmap to Saving and Investing?Do I Need to Prepare a Personal Financial Statement?

• What Should I Do If Someone Gives Me a Hot Tip About a Stock or Other Investment?

• How Can I Tell When Stock Prices Are About to Go Up or Down?

• What Are the Best Index Funds for Small Investors?

• Should I Invest in an ETF Instead of an Index Fund?

• What Is the Difference Between Buying TIPS and Buying Shares in a TIPS Mutual Fund?

• Is a 529 Plan the Only Way to Save for a Child’s College Education?

• If I Have Spare Cash Available, Am I Better Off Using It to Pay Off My Mortgage More Quickly or Investing It in Some Other Worry-Free Investing Asset? - The Worry-Free Toolbox.

Web Sites Related to Inflation-Protected Securities. Other Useful Tools and Web Sites. Dealing With Money When You Retire. Taking Your Risk Inventory.

March 5, 2009

This series of ten videos features School of Management Professor Zvi Bodiediscussing crucial topics in personal finance. From the hidden risks in your 401k to the age you should retire, Professor Bodie covers much of the ground in his book Worry-Free Investing.